![National Bank of Malawi]()

When I walked into the banking hall of National Bank – Mzuzu Service Centre – last week Friday, it was just a few minutes after lunch – around 12:16 after mid-day. I joined a troop of men and women and professionals and non-professionals all wanting to do this transaction and the other.

[caption id="attachment_98143" align="alignright" width="600"]

![National Bank of Malawi]()

National Bank of Malawi[/caption]

Apparently, an uncle of mine had sent me some money for my school errands and I had hastily rushed to the bank to withdraw. It was not a lot of money; that is, if I am to compare with the figures others, in front or behind me, were dealing with.

I had come to collect just K20 000.

But there was a problem. No. Let me say, I had a problem. I did not have a ‘valid’ identity card with me, and, therefore, there was no way I was going to withdraw any money from my savings account; a bank teller of medium height clad in a cream white shirt and a matching tie told be matter-of-factly.

That was after I had surrendered an official introduction letter from my school – Mzuzu University – duly signed and stamped by the Office of the Dean of Students.

I lost my wallet, I told him, in which all my cards were, including the ATM card.

Noticing my exasperation, and perhaps reading from my face and realizing how desperate I was in getting the money, the teller – one Dominic – referred me to the service center’s savings department, saying he would be in a position to help me if only they were able to identify me and give me a ‘go ahead’ with the transaction.

I did not argue. For two reasons. Firstly, it was because the teller was very right in not helping me because I did not have a ‘valid’ identity card as per the bank’s rules. He was protecting his job. The second reason I did not argue was his proposition that I go to the savings department. His suggestion, actually, had cooled down my heart like what cold water does to a worn-out journeying man.

I was sure they were going to easily identify me considering the fact that I have been a customer for about three years now, and for the fact that during the time I was opening the savings account with them, they had taken photos of me which they said, at the time, they would keep in their system for easy identification.

So, I walked across the banking hall to my far-right. On the counter that was empty was a young lady probably in her late twenties, with a smile so sumptuous. But I was in no smiling mood.

I wanted to have my money.

After stating my case, and showing her the letter of introduction and what the teller had advised, she walked towards her boss’ desk just behind her – apparently, her head in the savings department.

She came back with bad news for me. I had to go to the police station to report the loss of my wallet and the cards and then come back to the bank for help.

Are you not on MO626, she asked. No, I answered briefly. I was furious. It was way after one o’clock in the afternoon now.

Kindly enough, the police officer I met in the investigative department of Mzuzu Police Station was gentleman enough. He did not take long to understand my problem, and in the shortest period processed a report for me.

But when I got back to the back, I was faced with more problems. The same lady teller who had instructed me with the bank thing was still seated right behind her counter. She remembered me as I walked closer and without exchanging even a single word she got the documents I handed her and walked to her boss.

It was not her talking to me again as I expected. It was now her boss. He told me outright that even with the police report I could not get the money because it too was not a valid document for me to withdraw cash.

But wait a minute, there was an official stamp there from the police, and duly signed.

I asked what next then since I had told them I did not have an ATM card or any ID because I had lost them accidentally. I’d told him also that I had applied for a new card at my school and I could not get one until after one or two weeks. I needed the money but, I said staunchly.

But, like someone who had never gone to school for his job, he simply stared – blank.

Frustrated, I walked up the hall to the account relations manager suit who, surprisingly, did not take time to understand my predicament. A Mr. Chiumia, for that was his name, simply asked for the documents I had, punched a few keys on his laptop, called my Dean of Students for confirmation and then asked me to follow him.

In less than ten minutes, we were in the premium banking suite where I was given my money – K20 000 –, my own money after so much a struggle.

Ever since I left the bank that Friday, I have always probed myself with questions on why we must be slaves for banking with our banks. Why should a bank fail to identify their own customers? What is the use of the so many sample signatures they ask us to provide? What is the use of the photos they get when we open the accounts?

When I talked to a few hostel mates, they told me similar situations. It is actually not just National Bank. The other banks do it also.

A colleague told me that his bank, Standard Bank, had told him to wait for at least a week to get back a mere K5 000. Apparently, he had used his visa card to get the money from an NBS Bank ATM facility which had debited his account, but the ATM had not released the money. So, this colleague had to wait for over a week to have his money back. What a shame about the efficiency of our banks!

It is folly to save with Malawian banks. Sure it is!

Lira[/caption]

[caption id="attachment_54193" align="alignright" width="399"]

Lira[/caption]

[caption id="attachment_54193" align="alignright" width="399"] Lulu[/caption]

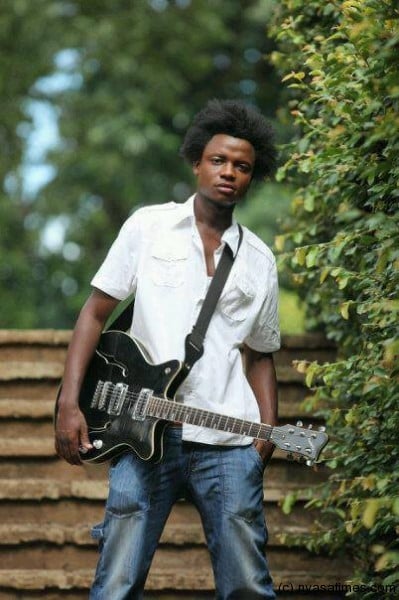

Lira will share the stage with Malawi’s own crooner Lawrence Khwisa, known on stage as Lulu.

Rated by The Star newspaper of South Africa as the “foremost adult contemporary female solo artist in South Africa”, Lira is an 11 times South African Music Award (SAMA) winning Afro-Soul vocalist whose music is a fusion of soul, funk, and Afro-jazz.

Unveiling Lira at Chameleon during a curtain-raiser show by Nesnes and Eunice Mhango, Head of Personal and Business Banking Margaret Kubwalo Chaika said the bank is proud to be hosting Lira during the concert.

“Lira is a musician who is on top of her game in contemporary music in South Africa. She leads the pack of Afro-pop and jazz divas on the continent and her resume as a platinum award-winning musician speaks volumes about her repertoire,” she said.

In an audio message to her fans in Malawi, released by Standard Bank Lira says she looks forward to her performance.

“This is Lira. I am so excited to be performing at this year’s Blue Mingoli concert on the 24th of October. I have heard a lot about the warm heart of Africa and what it has to offer and I’m truly honoured to be invited to headline this event.

"I would also like to take this opportunity to wish all the supporting acts all of the best. I am confident that together we will give a memorable concert. See you there!” she said.

Lulu[/caption]

Lira will share the stage with Malawi’s own crooner Lawrence Khwisa, known on stage as Lulu.

Rated by The Star newspaper of South Africa as the “foremost adult contemporary female solo artist in South Africa”, Lira is an 11 times South African Music Award (SAMA) winning Afro-Soul vocalist whose music is a fusion of soul, funk, and Afro-jazz.

Unveiling Lira at Chameleon during a curtain-raiser show by Nesnes and Eunice Mhango, Head of Personal and Business Banking Margaret Kubwalo Chaika said the bank is proud to be hosting Lira during the concert.

“Lira is a musician who is on top of her game in contemporary music in South Africa. She leads the pack of Afro-pop and jazz divas on the continent and her resume as a platinum award-winning musician speaks volumes about her repertoire,” she said.

In an audio message to her fans in Malawi, released by Standard Bank Lira says she looks forward to her performance.

“This is Lira. I am so excited to be performing at this year’s Blue Mingoli concert on the 24th of October. I have heard a lot about the warm heart of Africa and what it has to offer and I’m truly honoured to be invited to headline this event.

"I would also like to take this opportunity to wish all the supporting acts all of the best. I am confident that together we will give a memorable concert. See you there!” she said.

Nuka picking a team as Alide (far right) looks on, Pic Alex Mwazalumo.[/caption]

[caption id="attachment_93918" align="alignright" width="600"]

Nuka picking a team as Alide (far right) looks on, Pic Alex Mwazalumo.[/caption]

[caption id="attachment_93918" align="alignright" width="600"] Zakazaka announcing the cup format, Pic Alex Mwazalumo[/caption]

[caption id="attachment_93917" align="alignright" width="600"]

Zakazaka announcing the cup format, Pic Alex Mwazalumo[/caption]

[caption id="attachment_93917" align="alignright" width="600"] Its Silver! Eagles team manager Gabriel Chirwa send a text msge the draw, Pic Alex Mwazalumo[/caption]

[caption id="attachment_93920" align="alignright" width="600"]

Its Silver! Eagles team manager Gabriel Chirwa send a text msge the draw, Pic Alex Mwazalumo[/caption]

[caption id="attachment_93920" align="alignright" width="600"] Standard Bank, Fam officials show off the cup, Pic Alex Mwazalumo[/caption]

The Nomads, who have been ushered into this year’s edition of the Knock-Out competition by Standard Bank customers through a voting system after finishing on an unfamiliar ninth position during last year’s league season have a tricky military puzzle against another voted side Mafco to solve if they are to join the six seeded quarterfinalists.

The seeded quarterfinalists include defending league champions Big Bullets, Moyale Barracks, Blue Eagles, Civo United, Silver Strikers and Red Lions.

Another battle for the last eight slots will involve Kamuzu Barracks and Dedza Young Soccer, who have also sneaked in via a voting process.

Should Wanderers or the Salima based Soccer Instructors make it to the quarterfinals, they will face another military hurdle in the name of Red Lions. The winner between Kamuzu Barracks and Dedza Young Soccer will meet Civo in the quarterfinals.

Big Bullets, alias The People’s team have been drawn against Moyale Barracks, the soldiers from Kaning’ina in another explosive quarterfinal with struggling central giants Silver Strikers paired against Blue Eagles.

In the semi-finals, winner between Moyale and Bullets will meet the winner between Civo and Kamuzu Barracks/Dedza Young Soccer with Red Lions/Wanderers/Mafco lining up against Silver/Blue Eagles.

According to Football Association of Malawi’s (Fam) competitions manager Gomezgani Zakazaka, the preliminary play-offs have been slated for September 12/13 with the quarterfinals scheduled for September 27/27. Semi-finals will be played on October 16/17 whereas the final is set to be staged on October 31, 2015.

Much as the first drawn teams are deemed as home teams, Zakazaka stressed that Article 8.1 of the competition’s rules and regulations empowers the organising committee to determine match venues, depending on conditions of the playing venues and other factors.

Chairman of the organising committee and Fam legal advisor Jabar Alide hailed Standard Bank for sponsoring the competition for a 10th season, pledging the organisers would see to it that it should be another incident free competition.

Alide disclosed that the organising committee has decided increase the winner’s prize from K9 million to K10 million while the runner-up is set to walk away K5 million richer. He said semi-finalists will pocket K500,000 each, a decrease from last year’s K1 million and that there will be no prizes for quarterfinalists.

Standard Bank’s head of Information Technology William Nuka said the sponsors were looking forward to another exciting football tournament.

“Standard Bank has been sponsoring this cup for nine years and we are looking forward to an exciting 10th anniversary, which will be full of surprises. It is our sincere hope that all the teams and their fans will conduct themselves in an orderly manner. We do not want violence or hooliganism to be a show-stopper as this would curtail our goal of assisting in the development of football in Malawi,” said Nuka.

The Standard Bank head of IT hailed the bank’s customers for patronising the voting process in large numbers.

The voting outcome was as follows: Be Forward Wanderers 1.045 votes, Mafco 395, Kamuzu Barracks 298, Dedza Young Soccer 253, Airborne Rangers 226, FISD Wizzards 189, Azam Tigers 169, Mzuni 55 and Epac 54.

Below is the full draw for the 2015 edition:

Preliminary Play-offs

Mafco vs Be Forward Wanderers

Kamuzu Barracks vs Dedza Young Soccer

Quarterfinals

Civo vs Winner Game 1

Red Lions vs Winner Game 2

Silver vs Blue Eagles

Moyale vs Bullets

Semi-finals

Moyale/Bullets vs Civo/KB/Dedza

Red Lions/Wanderers/Mafco vs Silver/Blue Eagles

Standard Bank, Fam officials show off the cup, Pic Alex Mwazalumo[/caption]

The Nomads, who have been ushered into this year’s edition of the Knock-Out competition by Standard Bank customers through a voting system after finishing on an unfamiliar ninth position during last year’s league season have a tricky military puzzle against another voted side Mafco to solve if they are to join the six seeded quarterfinalists.

The seeded quarterfinalists include defending league champions Big Bullets, Moyale Barracks, Blue Eagles, Civo United, Silver Strikers and Red Lions.

Another battle for the last eight slots will involve Kamuzu Barracks and Dedza Young Soccer, who have also sneaked in via a voting process.

Should Wanderers or the Salima based Soccer Instructors make it to the quarterfinals, they will face another military hurdle in the name of Red Lions. The winner between Kamuzu Barracks and Dedza Young Soccer will meet Civo in the quarterfinals.

Big Bullets, alias The People’s team have been drawn against Moyale Barracks, the soldiers from Kaning’ina in another explosive quarterfinal with struggling central giants Silver Strikers paired against Blue Eagles.

In the semi-finals, winner between Moyale and Bullets will meet the winner between Civo and Kamuzu Barracks/Dedza Young Soccer with Red Lions/Wanderers/Mafco lining up against Silver/Blue Eagles.

According to Football Association of Malawi’s (Fam) competitions manager Gomezgani Zakazaka, the preliminary play-offs have been slated for September 12/13 with the quarterfinals scheduled for September 27/27. Semi-finals will be played on October 16/17 whereas the final is set to be staged on October 31, 2015.

Much as the first drawn teams are deemed as home teams, Zakazaka stressed that Article 8.1 of the competition’s rules and regulations empowers the organising committee to determine match venues, depending on conditions of the playing venues and other factors.

Chairman of the organising committee and Fam legal advisor Jabar Alide hailed Standard Bank for sponsoring the competition for a 10th season, pledging the organisers would see to it that it should be another incident free competition.

Alide disclosed that the organising committee has decided increase the winner’s prize from K9 million to K10 million while the runner-up is set to walk away K5 million richer. He said semi-finalists will pocket K500,000 each, a decrease from last year’s K1 million and that there will be no prizes for quarterfinalists.

Standard Bank’s head of Information Technology William Nuka said the sponsors were looking forward to another exciting football tournament.

“Standard Bank has been sponsoring this cup for nine years and we are looking forward to an exciting 10th anniversary, which will be full of surprises. It is our sincere hope that all the teams and their fans will conduct themselves in an orderly manner. We do not want violence or hooliganism to be a show-stopper as this would curtail our goal of assisting in the development of football in Malawi,” said Nuka.

The Standard Bank head of IT hailed the bank’s customers for patronising the voting process in large numbers.

The voting outcome was as follows: Be Forward Wanderers 1.045 votes, Mafco 395, Kamuzu Barracks 298, Dedza Young Soccer 253, Airborne Rangers 226, FISD Wizzards 189, Azam Tigers 169, Mzuni 55 and Epac 54.

Below is the full draw for the 2015 edition:

Preliminary Play-offs

Mafco vs Be Forward Wanderers

Kamuzu Barracks vs Dedza Young Soccer

Quarterfinals

Civo vs Winner Game 1

Red Lions vs Winner Game 2

Silver vs Blue Eagles

Moyale vs Bullets

Semi-finals

Moyale/Bullets vs Civo/KB/Dedza

Red Lions/Wanderers/Mafco vs Silver/Blue Eagles

Unyolo: Standard Bank partners Umodzi Park[/caption]

Announcing the partnership Standard Bank Head of Marketing Thoko Unyolo said through the partnership Umodzi Park will provide hospitality services, including accommodation for the headline artist South Africa’s award winning vocalist, Lira and her team.

“With preparations for the show at an advanced stage, we are pleased to partner President Wilmot Hotel, Umodzi Park for the inaugural Blue Mingoli music concert” said Unyolo.

The South African hotel chain also manages the adjacent Bingu International Conference Centre (BICC) which will stage the October 24 concert.

Apart from Umodzi Park Standard Bank is also working with ZBS, MBC and Nation Publications as media and broadcast partners and South African Airways (SAA) as official airline partner.

Commenting on preparations for the show Unyolo said preparations are at an advanced stage.

“We would like to keep our promise to make the Blue Mingoli concert a memorable experience for our customers and all music lovers,” she said.

Unyolo: Standard Bank partners Umodzi Park[/caption]

Announcing the partnership Standard Bank Head of Marketing Thoko Unyolo said through the partnership Umodzi Park will provide hospitality services, including accommodation for the headline artist South Africa’s award winning vocalist, Lira and her team.

“With preparations for the show at an advanced stage, we are pleased to partner President Wilmot Hotel, Umodzi Park for the inaugural Blue Mingoli music concert” said Unyolo.

The South African hotel chain also manages the adjacent Bingu International Conference Centre (BICC) which will stage the October 24 concert.

Apart from Umodzi Park Standard Bank is also working with ZBS, MBC and Nation Publications as media and broadcast partners and South African Airways (SAA) as official airline partner.

Commenting on preparations for the show Unyolo said preparations are at an advanced stage.

“We would like to keep our promise to make the Blue Mingoli concert a memorable experience for our customers and all music lovers,” she said.

One of the blocks[/caption]

Chitsime who hails from Che Januare village in the area of Sub Traditional Authority Onga in Chiradzulu where the school has been constructed, retired as Standard Bank Chairman of the Board in 2014 and was replaced by another eminent business executive Dr Rex Harawa.

Speaking during the hand over of the project, Chitsime said the investment by Standard Bank demonstrate the Bank’s commitment to the development of education in the country.

“On April 8 this year, I stood here again when we witnessed the ground breaking ceremony and few months down the line the project is completed. I’m grateful and delighted that Standard Bank has fulfilled its promised with this project of magnitude and it has really honored me and the entire community,” said Chitsime.

Chitsime said the junior primary school which has been named Mkuyu represents a treasure for the people of Che Januare as it will help to shape future leaders of the country.

He said before the construction of the new school children had to walk a distance of 8 kilometers to access the education

“This is no ordinary gift and I am very humbled to be given such project which is not only for the people in this area but also for the whole country,” he said.

The Bank’s current Chairman Dr Rex Harawa hailed Chitsime for the contribution towards the growth of Standard Bank.

“Mr. Chitsime contributed significantly to the growth of Standard Bank during his tenure of office and the only thank you we could have given him is this project “said Harawa

Dr Harawa said Standard Bank will continue to lead in responding to the needs of the people among which is provision of access to education in the country.

In her remarks Secretary for Education Science and Technology Lonely Magreta hailed Standard Bank for the contribution towards the access to education.

“As government we are grateful to Standard Bank for the gift of this classroom blocks. I have been informed that there is no any other school in the district whose infrastructure can match the standard that we are receiving today,” Magreta said.

Magreta said the donation will contribute towards the reduction of shortage of classrooms in the government schools.

“The problem of inadequate infrastructure exists in many schools in the country and currently close to 38,000 classrooms are needed if we were to accommodate all learners inside the classroom,” she said.

One of the blocks[/caption]

Chitsime who hails from Che Januare village in the area of Sub Traditional Authority Onga in Chiradzulu where the school has been constructed, retired as Standard Bank Chairman of the Board in 2014 and was replaced by another eminent business executive Dr Rex Harawa.

Speaking during the hand over of the project, Chitsime said the investment by Standard Bank demonstrate the Bank’s commitment to the development of education in the country.

“On April 8 this year, I stood here again when we witnessed the ground breaking ceremony and few months down the line the project is completed. I’m grateful and delighted that Standard Bank has fulfilled its promised with this project of magnitude and it has really honored me and the entire community,” said Chitsime.

Chitsime said the junior primary school which has been named Mkuyu represents a treasure for the people of Che Januare as it will help to shape future leaders of the country.

He said before the construction of the new school children had to walk a distance of 8 kilometers to access the education

“This is no ordinary gift and I am very humbled to be given such project which is not only for the people in this area but also for the whole country,” he said.

The Bank’s current Chairman Dr Rex Harawa hailed Chitsime for the contribution towards the growth of Standard Bank.

“Mr. Chitsime contributed significantly to the growth of Standard Bank during his tenure of office and the only thank you we could have given him is this project “said Harawa

Dr Harawa said Standard Bank will continue to lead in responding to the needs of the people among which is provision of access to education in the country.

In her remarks Secretary for Education Science and Technology Lonely Magreta hailed Standard Bank for the contribution towards the access to education.

“As government we are grateful to Standard Bank for the gift of this classroom blocks. I have been informed that there is no any other school in the district whose infrastructure can match the standard that we are receiving today,” Magreta said.

Magreta said the donation will contribute towards the reduction of shortage of classrooms in the government schools.

“The problem of inadequate infrastructure exists in many schools in the country and currently close to 38,000 classrooms are needed if we were to accommodate all learners inside the classroom,” she said.

National Bank of Malawi[/caption]

Apparently, an uncle of mine had sent me some money for my school errands and I had hastily rushed to the bank to withdraw. It was not a lot of money; that is, if I am to compare with the figures others, in front or behind me, were dealing with.

I had come to collect just K20 000.

But there was a problem. No. Let me say, I had a problem. I did not have a ‘valid’ identity card with me, and, therefore, there was no way I was going to withdraw any money from my savings account; a bank teller of medium height clad in a cream white shirt and a matching tie told be matter-of-factly.

That was after I had surrendered an official introduction letter from my school – Mzuzu University – duly signed and stamped by the Office of the Dean of Students.

I lost my wallet, I told him, in which all my cards were, including the ATM card.

Noticing my exasperation, and perhaps reading from my face and realizing how desperate I was in getting the money, the teller – one Dominic – referred me to the service center’s savings department, saying he would be in a position to help me if only they were able to identify me and give me a ‘go ahead’ with the transaction.

I did not argue. For two reasons. Firstly, it was because the teller was very right in not helping me because I did not have a ‘valid’ identity card as per the bank’s rules. He was protecting his job. The second reason I did not argue was his proposition that I go to the savings department. His suggestion, actually, had cooled down my heart like what cold water does to a worn-out journeying man.

I was sure they were going to easily identify me considering the fact that I have been a customer for about three years now, and for the fact that during the time I was opening the savings account with them, they had taken photos of me which they said, at the time, they would keep in their system for easy identification.

So, I walked across the banking hall to my far-right. On the counter that was empty was a young lady probably in her late twenties, with a smile so sumptuous. But I was in no smiling mood.

I wanted to have my money.

After stating my case, and showing her the letter of introduction and what the teller had advised, she walked towards her boss’ desk just behind her – apparently, her head in the savings department.

She came back with bad news for me. I had to go to the police station to report the loss of my wallet and the cards and then come back to the bank for help.

Are you not on MO626, she asked. No, I answered briefly. I was furious. It was way after one o’clock in the afternoon now.

Kindly enough, the police officer I met in the investigative department of Mzuzu Police Station was gentleman enough. He did not take long to understand my problem, and in the shortest period processed a report for me.

But when I got back to the back, I was faced with more problems. The same lady teller who had instructed me with the bank thing was still seated right behind her counter. She remembered me as I walked closer and without exchanging even a single word she got the documents I handed her and walked to her boss.

It was not her talking to me again as I expected. It was now her boss. He told me outright that even with the police report I could not get the money because it too was not a valid document for me to withdraw cash.

But wait a minute, there was an official stamp there from the police, and duly signed.

I asked what next then since I had told them I did not have an ATM card or any ID because I had lost them accidentally. I’d told him also that I had applied for a new card at my school and I could not get one until after one or two weeks. I needed the money but, I said staunchly.

But, like someone who had never gone to school for his job, he simply stared – blank.

Frustrated, I walked up the hall to the account relations manager suit who, surprisingly, did not take time to understand my predicament. A Mr. Chiumia, for that was his name, simply asked for the documents I had, punched a few keys on his laptop, called my Dean of Students for confirmation and then asked me to follow him.

In less than ten minutes, we were in the premium banking suite where I was given my money – K20 000 –, my own money after so much a struggle.

Ever since I left the bank that Friday, I have always probed myself with questions on why we must be slaves for banking with our banks. Why should a bank fail to identify their own customers? What is the use of the so many sample signatures they ask us to provide? What is the use of the photos they get when we open the accounts?

When I talked to a few hostel mates, they told me similar situations. It is actually not just National Bank. The other banks do it also.

A colleague told me that his bank, Standard Bank, had told him to wait for at least a week to get back a mere K5 000. Apparently, he had used his visa card to get the money from an NBS Bank ATM facility which had debited his account, but the ATM had not released the money. So, this colleague had to wait for over a week to have his money back. What a shame about the efficiency of our banks!

It is folly to save with Malawian banks. Sure it is!

National Bank of Malawi[/caption]

Apparently, an uncle of mine had sent me some money for my school errands and I had hastily rushed to the bank to withdraw. It was not a lot of money; that is, if I am to compare with the figures others, in front or behind me, were dealing with.

I had come to collect just K20 000.

But there was a problem. No. Let me say, I had a problem. I did not have a ‘valid’ identity card with me, and, therefore, there was no way I was going to withdraw any money from my savings account; a bank teller of medium height clad in a cream white shirt and a matching tie told be matter-of-factly.

That was after I had surrendered an official introduction letter from my school – Mzuzu University – duly signed and stamped by the Office of the Dean of Students.

I lost my wallet, I told him, in which all my cards were, including the ATM card.

Noticing my exasperation, and perhaps reading from my face and realizing how desperate I was in getting the money, the teller – one Dominic – referred me to the service center’s savings department, saying he would be in a position to help me if only they were able to identify me and give me a ‘go ahead’ with the transaction.

I did not argue. For two reasons. Firstly, it was because the teller was very right in not helping me because I did not have a ‘valid’ identity card as per the bank’s rules. He was protecting his job. The second reason I did not argue was his proposition that I go to the savings department. His suggestion, actually, had cooled down my heart like what cold water does to a worn-out journeying man.

I was sure they were going to easily identify me considering the fact that I have been a customer for about three years now, and for the fact that during the time I was opening the savings account with them, they had taken photos of me which they said, at the time, they would keep in their system for easy identification.

So, I walked across the banking hall to my far-right. On the counter that was empty was a young lady probably in her late twenties, with a smile so sumptuous. But I was in no smiling mood.

I wanted to have my money.

After stating my case, and showing her the letter of introduction and what the teller had advised, she walked towards her boss’ desk just behind her – apparently, her head in the savings department.

She came back with bad news for me. I had to go to the police station to report the loss of my wallet and the cards and then come back to the bank for help.

Are you not on MO626, she asked. No, I answered briefly. I was furious. It was way after one o’clock in the afternoon now.

Kindly enough, the police officer I met in the investigative department of Mzuzu Police Station was gentleman enough. He did not take long to understand my problem, and in the shortest period processed a report for me.

But when I got back to the back, I was faced with more problems. The same lady teller who had instructed me with the bank thing was still seated right behind her counter. She remembered me as I walked closer and without exchanging even a single word she got the documents I handed her and walked to her boss.

It was not her talking to me again as I expected. It was now her boss. He told me outright that even with the police report I could not get the money because it too was not a valid document for me to withdraw cash.

But wait a minute, there was an official stamp there from the police, and duly signed.

I asked what next then since I had told them I did not have an ATM card or any ID because I had lost them accidentally. I’d told him also that I had applied for a new card at my school and I could not get one until after one or two weeks. I needed the money but, I said staunchly.

But, like someone who had never gone to school for his job, he simply stared – blank.

Frustrated, I walked up the hall to the account relations manager suit who, surprisingly, did not take time to understand my predicament. A Mr. Chiumia, for that was his name, simply asked for the documents I had, punched a few keys on his laptop, called my Dean of Students for confirmation and then asked me to follow him.

In less than ten minutes, we were in the premium banking suite where I was given my money – K20 000 –, my own money after so much a struggle.

Ever since I left the bank that Friday, I have always probed myself with questions on why we must be slaves for banking with our banks. Why should a bank fail to identify their own customers? What is the use of the so many sample signatures they ask us to provide? What is the use of the photos they get when we open the accounts?

When I talked to a few hostel mates, they told me similar situations. It is actually not just National Bank. The other banks do it also.

A colleague told me that his bank, Standard Bank, had told him to wait for at least a week to get back a mere K5 000. Apparently, he had used his visa card to get the money from an NBS Bank ATM facility which had debited his account, but the ATM had not released the money. So, this colleague had to wait for over a week to have his money back. What a shame about the efficiency of our banks!

It is folly to save with Malawian banks. Sure it is!

Standard Bank Models with the glittering trophy: No more knock-out[/caption]

The bank announced on Friday they have withdrawn the sponsorship, citing “changes in macroeconomic environment” as reasons.

In a statement made available to Nyasa Times, Standard Bank said it has become increasingly challenging to grow the revenue of the bank at a pace that match the increasing costs of running the trophy.

“In light of the changes in the macroeconomic environment and all the attendant business challenges, the bank has had to refocus its strategy,” a statement says.

Standard Bank says it has become “increasingly challenging” to grow the revenue of the bank at a pace which allows the financial institution matches the increase in costs.

“We have been forced by these circumstances to become more introspective about how we think about continuing to build a sustainable business going into the future. As a consequence, we have had to take a closer look at our revenue structure and potential, as well as our cost structure, and we have unfortunately found ourselves needing to make some uncomfortable decisions,” the bank said.

Standard Bank has been bankrolling the trophy since 2007 and the bank said they are “very proud “of the contribution they have made towards football development in the country.

“It goes without saying that football standards have improved as witnessed by the record number of players that have turned professional,” the statement adds.

Standard Bank Cup organising committee chairperson Jabber Alide expressed “shock” with the bank’s announcement.

Civo United are cup holders of the Knock-Out after they defeated Mighty Be Forward Wanderers.

Standard Bank Models with the glittering trophy: No more knock-out[/caption]

The bank announced on Friday they have withdrawn the sponsorship, citing “changes in macroeconomic environment” as reasons.

In a statement made available to Nyasa Times, Standard Bank said it has become increasingly challenging to grow the revenue of the bank at a pace that match the increasing costs of running the trophy.

“In light of the changes in the macroeconomic environment and all the attendant business challenges, the bank has had to refocus its strategy,” a statement says.

Standard Bank says it has become “increasingly challenging” to grow the revenue of the bank at a pace which allows the financial institution matches the increase in costs.

“We have been forced by these circumstances to become more introspective about how we think about continuing to build a sustainable business going into the future. As a consequence, we have had to take a closer look at our revenue structure and potential, as well as our cost structure, and we have unfortunately found ourselves needing to make some uncomfortable decisions,” the bank said.

Standard Bank has been bankrolling the trophy since 2007 and the bank said they are “very proud “of the contribution they have made towards football development in the country.

“It goes without saying that football standards have improved as witnessed by the record number of players that have turned professional,” the statement adds.

Standard Bank Cup organising committee chairperson Jabber Alide expressed “shock” with the bank’s announcement.

Civo United are cup holders of the Knock-Out after they defeated Mighty Be Forward Wanderers.

Simwaka: Bank employees put extraordinary effort resulting in an improved profitability[/caption]

[caption id="attachment_105315" align="alignright" width="600"]

Simwaka: Bank employees put extraordinary effort resulting in an improved profitability[/caption]

[caption id="attachment_105315" align="alignright" width="600"] Standard Bank[/caption]

[caption id="attachment_108483" align="alignright" width="339"]

Standard Bank[/caption]

[caption id="attachment_108483" align="alignright" width="339"] A customer holds a Standard Bank card[/caption]

Announcing the launch in Lilongwe, Standard Bank Head of Personal and Business Banking, Margaret Kubwalo-Chaika said the new card offers prestige services to its customers.

“We at Standard Bank pledge to continue bringing innovative products and services to achieve excellence in the delivery of our services to customers “said Chaika.

Chaika said the Visa Platinum Debit Card is a new product with exclusive features like the highly secure new chip and pin that will see private bankers transact across the world with minimal risk.

“This platinum card among others exclusive benefits which include a guaranteed 24/7 world-wide concierge service, travel accident insurance, travel perks, lifestyle privileges and shopping rewards, zero liability and an end to queues,” she said.

According to Chaika, for customers to access Platinum Visa Card they will have to bring in their old cards and apply for the Visa Platinum cards.

“With the release of the new card which will be offered for free for those whose cards would not have expired in this year, the old cards will have to be returned to the bank and be destroyed to avoid inconveniences, “said Chaika.

The whole process will be done at the Private Banking suites and the bankers have been duly trained on how to handle the process.

She said Standard Bank always goes an extra mile to demonstrate capability in offering tailor-made products and services to its customers. Customers can contact their private bankers who will gladly guide them on the whole process.

A customer holds a Standard Bank card[/caption]

Announcing the launch in Lilongwe, Standard Bank Head of Personal and Business Banking, Margaret Kubwalo-Chaika said the new card offers prestige services to its customers.

“We at Standard Bank pledge to continue bringing innovative products and services to achieve excellence in the delivery of our services to customers “said Chaika.

Chaika said the Visa Platinum Debit Card is a new product with exclusive features like the highly secure new chip and pin that will see private bankers transact across the world with minimal risk.

“This platinum card among others exclusive benefits which include a guaranteed 24/7 world-wide concierge service, travel accident insurance, travel perks, lifestyle privileges and shopping rewards, zero liability and an end to queues,” she said.

According to Chaika, for customers to access Platinum Visa Card they will have to bring in their old cards and apply for the Visa Platinum cards.

“With the release of the new card which will be offered for free for those whose cards would not have expired in this year, the old cards will have to be returned to the bank and be destroyed to avoid inconveniences, “said Chaika.

The whole process will be done at the Private Banking suites and the bankers have been duly trained on how to handle the process.

She said Standard Bank always goes an extra mile to demonstrate capability in offering tailor-made products and services to its customers. Customers can contact their private bankers who will gladly guide them on the whole process.